Ginko Currency Services (GCS) and Apez Currency Exchange (ACE) are both companies active on the currency exchange market.

Ginko Currency Services (GCS) and Apez Currency Exchange (ACE) are both companies active on the currency exchange market.

Seen the recent quotation of ACE and the fact that it never has distributed dividend, we have to valuate the company based on her net income.

Analysis of the prospectus, shows that the price/EPS of GCS is 72.83 against 202 for ACE. The ratio indicates that it will take 72 month of earnings to payback the initial capital investment in GCS, against 202 months for ACE.

The Earning Yield, the equivalent of the Dividend Yield but calculated on the net earnings, indicates on the other hand the percentual monthly return, which is 1.37 % for CGS and a pale 0.49 % for ACE.

The Earning Margin, or the capacity to generate earnings, is favorable for ACE with a 6.09 % almost the double compared to GCS. On the other hand, earnings per share or EPS, is only 0.069 for GCS, almost 9x the ridiculous value of ACE.

Conclusion

The Earning Margin on it's own, almost twice as big for ACE compared to GCS, is insufficient to justify the extremely excessive pricing of ACE. Furthermore, a Price/EPS ratio of 72 and a Earning Yield of barely 1.37%, indicate clearly an over valuation of the CGS shares at the 5L$/share price level. The same is equally true for ACE with multiples 3x higher than GCS.

In the meanwhile, based on current data, Pb Asset Management remains negative on GCS and strongly negative on ACE. Only a price drop, below 3 L$ for GCS and 0.5L $ for ACE, will make these shares interesting.

Pasha Boucher

Translation by Bella March

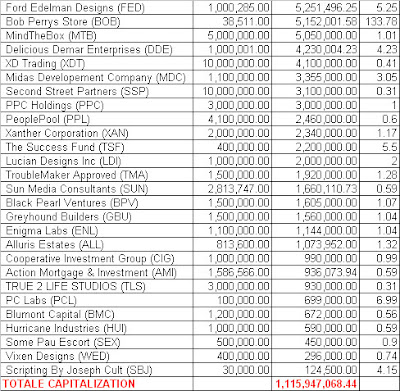

The WSE, 2 months after the opening, has reached a market capitalization of more than 1 billion Linden Dollars, or the equivalent of more than 4 million American Dollars.

The WSE, 2 months after the opening, has reached a market capitalization of more than 1 billion Linden Dollars, or the equivalent of more than 4 million American Dollars.